Getting My Unicorn Financial Services To Work

Wiki Article

Some Ideas on Home Loan Broker Melbourne You Should Know

Table of ContentsGetting The Loan Broker Melbourne To WorkThings about Melbourne Mortgage Brokers10 Easy Facts About Melbourne Mortgage Brokers DescribedThe smart Trick of Unicorn Financial Services That Nobody is Talking AboutBroker Melbourne - Questions

An expert home mortgage broker originates, bargains, and also processes residential and also industrial mortgage finances on behalf of the client. Below is a six factor guide to the services you ought to be provided and also the expectations you ought to have of a qualified mortgage broker: A home loan broker offers a wide variety of home mortgage car loans from a variety of various lending institutions.A mortgage broker represents your interests instead than the rate of interests of a loan provider. They need to act not only as your agent, yet as an educated specialist as well as problem solver. With access to a variety of mortgage items, a broker has the ability to offer you the best value in terms of rate of interest, settlement quantities, as well as financing products (mortgage broker melbourne).

Lots of circumstances require greater than the simple use a three decades, 15 year, or adjustable price home loan (ARM), so innovative mortgage techniques as well as advanced services are the advantage of functioning with a skilled mortgage broker (https://topbusinesslisting.com/mortgage-broker/unicorn-financial-services-springvale-victoria/). A home loan broker browses the client through any type of circumstance, handling the process as well as smoothing any kind of bumps in the roadway along the method.

Borrowers that find they need larger loans than their financial institution will accept additionally advantage from a broker's understanding and also capability to successfully obtain financing. With a home mortgage broker, you only require one application, as opposed to completing forms for each individual loan provider. Your home loan broker can offer a formal contrast of any type of fundings suggested, leading you to the info that precisely portrays cost differences, with existing rates, points, and also closing expenses for every financing mirrored.

All about Mortgage Brokers Melbourne

A respectable mortgage broker will reveal how they are spent for their solutions, along with detail the total prices for the finance. Personalized solution is the setting apart variable when picking a home loan broker. You should anticipate your home loan broker to assist smooth the method, be offered to you, and suggest you throughout the closing process.

Working with a home mortgage broker can potentially conserve you time, effort, and money. A home mortgage broker might have better as well as a lot more access to lenders than you have. However, a broker's interests might not be aligned with your own - refinance broker melbourne. You may get a better bargain on a funding by dealing directly with lending institutions.

A Biased View of Loan Broker Melbourne

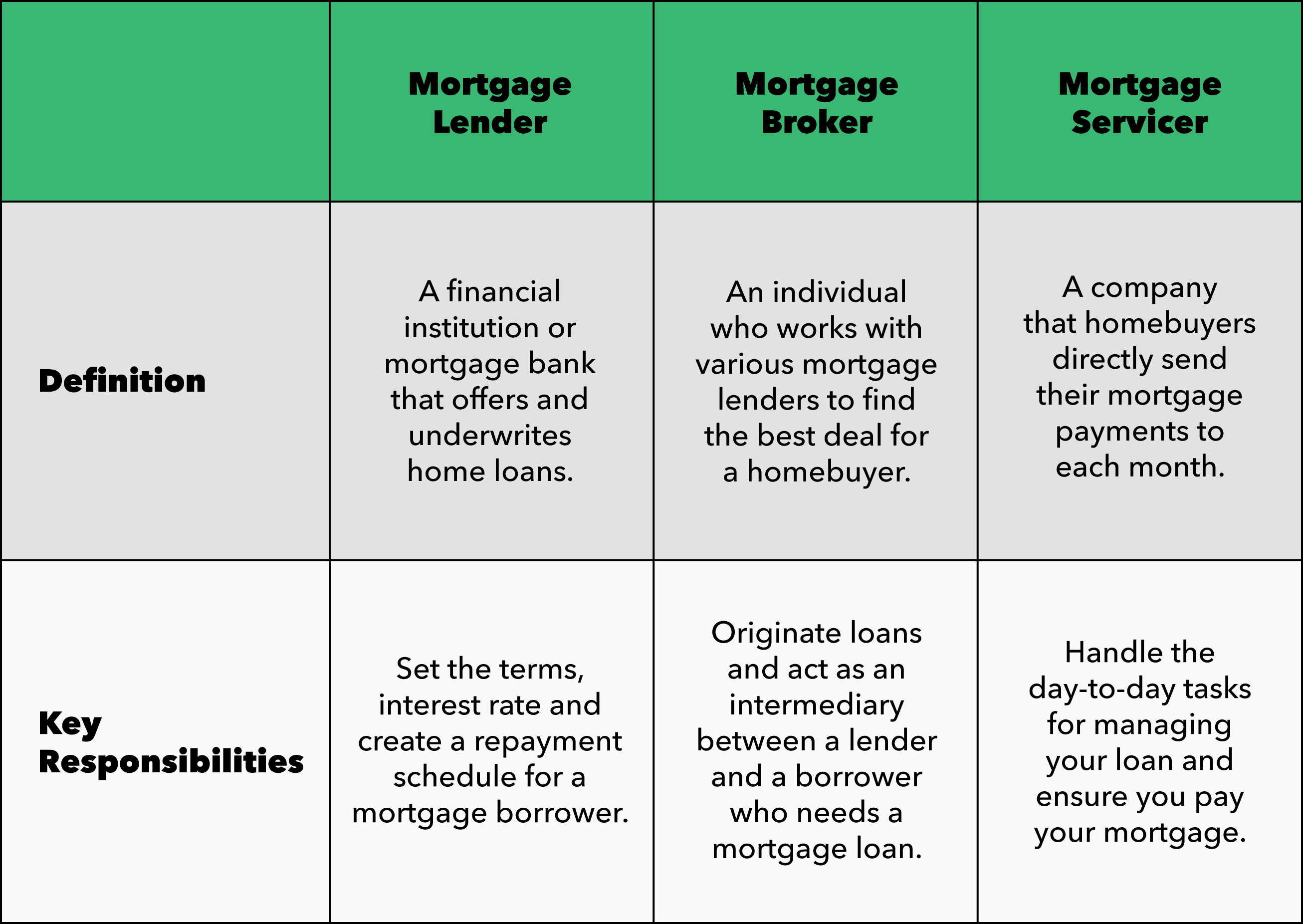

A mortgage broker carries out as intermediator for a banks that offers car loans that are secured with genuine estate as well as individuals who wish to purchase actual estate and also require a loan to do so. The home loan broker functions with both customer as well as lender to obtain the consumer accepted for the lending.A home loan broker generally works with several lending institutions as well as can provide a variety of car loan options to the consumer (https://thebestbizlistings.com/mortgage-broker/unicorn-financial-services-springvale-victoria/). A borrower does not need to deal with a home loan broker. They can function directly with a lender if they so choose. A loan provider is a banks (or specific) that can offer the funds for the actual estate transaction.

A lender can be a bank, a credit history union, or other monetary venture. Prospective home buyers can go directly to any kind of lending institution for a lending. While a mortgage broker isn't needed to facilitate the transaction, some lenders may just resolve home mortgage brokers. So if the lending institution you like is amongst those, you'll require to use a mortgage broker.

They're the person that you'll take care of if you come close to a loan provider for a funding. The financing policeman can assist a customer recognize as well as choose from the lendings supplied by the lending institution. They'll respond to all questions, aid a borrower obtain pre-qualified for a loan, and aid with the application process.

The 4-Minute Rule for Mortgage Broker In Melbourne

Mortgage brokers don't supply the funds for fundings or approve lending applications. They assist people seeking house car loans to locate a lending institution that can fund their house purchase. Start by making certain you understand what a home loan broker does. Ask close friends, family members, and also business colleagues for references. Take an appearance at on the internet evaluations and also check for complaints.Inquire about their experience, the precise assistance that they'll offer, the costs they bill, and how they're paid (by loan provider or debtor). Additionally ask whether they can help you in particular, offered your details monetary circumstances.

Encountered with the predicament of whether or not to utilize a mortgage broker or a loan provider from a financial institution? When you are looking to purchase a house, however, there are 4 essential components that mortgage brokers can supply you that the lenders at the bank simply can not.

Individual touch appears to be increasingly much less usual in today's society, but it should not be. None of us live the same life as an additional, so customization is crucial! Acquiring a residence is kind of a huge bargain! At Eagle Mortgage Business, individual touch is something we satisfaction ourselves in. You get to work with one of our agents personally, who has years of experience as well as can respond to any type of inquiries you might have.

The Facts About Broker Melbourne Revealed

Banks, on the various other hand, have a limited routine. Their other hours of procedure are typically while you're already at job. That has the time for that? In addition to, every vacation is a national holiday. Obtain the personal touch you deserve with a home loan broker that cares! The versatility a home loan broker can use you is just one more factor to stay clear of mosting likely to the bank.

Report this wiki page